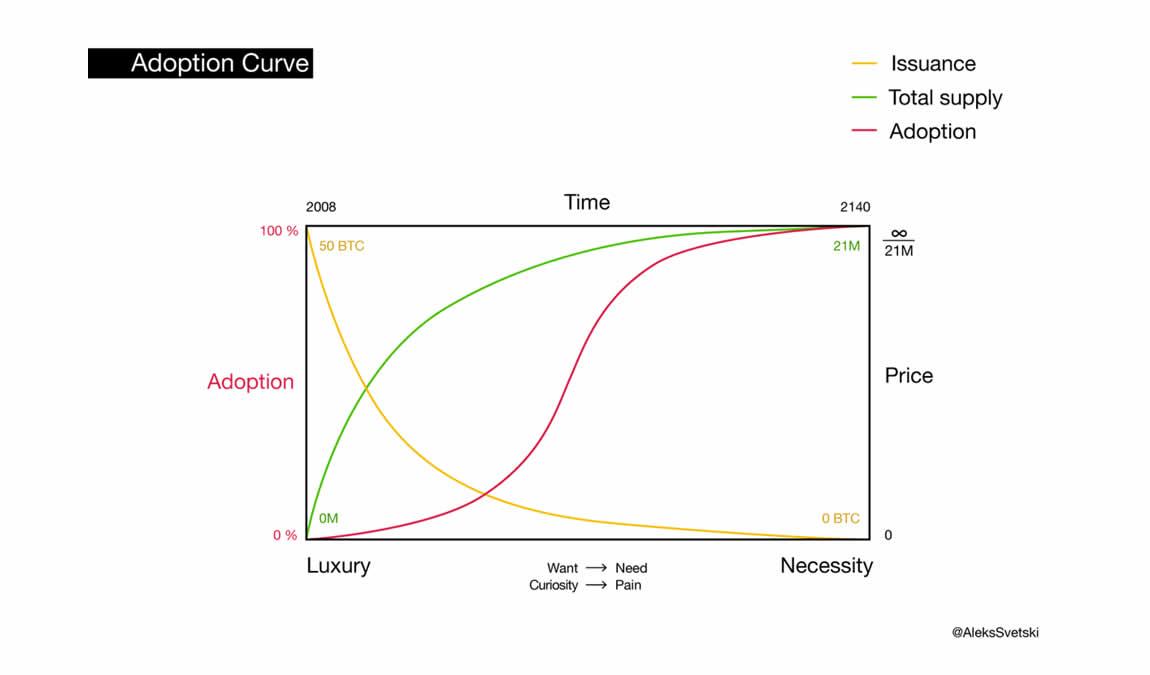

Bitcoin has a fixed supply, set at 21 million coins. We apologize for the typo on Friday saying 12 million coins. The limit is and always has been 21 million. This supply limit will be reached somewhere around 2130 – 2140. Anyone reading our blog knows, Bitcoin supply is cut 50% every 210,000 blocks mined on the blockchain. Each block averages 10 minutes, so that comes out to every 4 years. This is why Bitcoin cycles are in 4 year intervals. This is what gives Bitcoin it’s rhythmic nature. We also know, money supply cannot be slowed down under the current monetary system. Reverse Repo market ensures that 20% of broad money supply has to be replaced on a very regular basis to keep commercial bank liquidity up. Also, 10 year treasury bond yields will go up fast, if money supply growth is tightened. Therefore, central banks have to keep printing and devaluing all currency globally. The USD is at the top of this list, or very near the top. This pumps Bitcoin because of the scarcity it has. Its inelastic supply written into the protocol causes this:

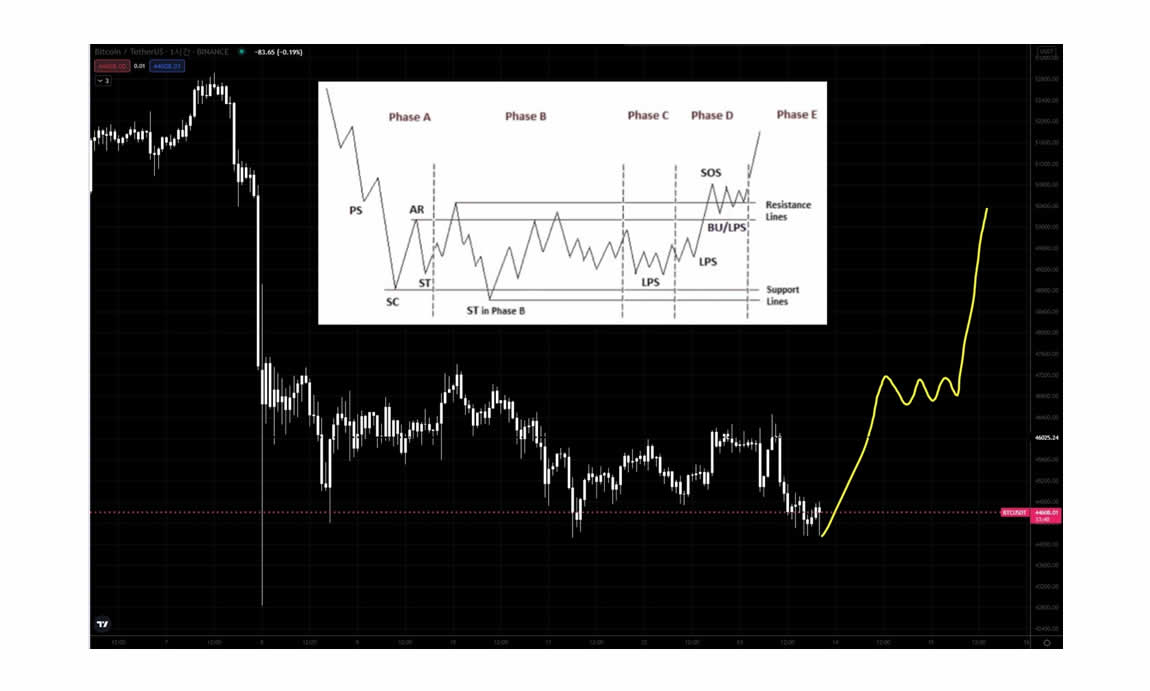

Of course, central banks don’t like competing technologies to fiat currency. Major banks, as we have mentioned in previous blogs are shorting Bitcoin. It appears to continue in the Wyckoff Distribution pattern we talked a lot about a month ago or so. Bitcoin broke $40K then $50K, then broke $50K again. Only to fall back into the upper and mid $40K’s. The Wyckoff Distribution pattern explains this. Institutional investors have not accumulated enough Bitcoin yet, and until they do, they apparently can short it enough, to hold it back for a time. See the chart and comparison:

We have seen analysis, that we are in phase C and in phase D. We agree, there should be strong resistance below $60K which explains another consolidation period in October before it goes parabolic. Either way, patience is key!

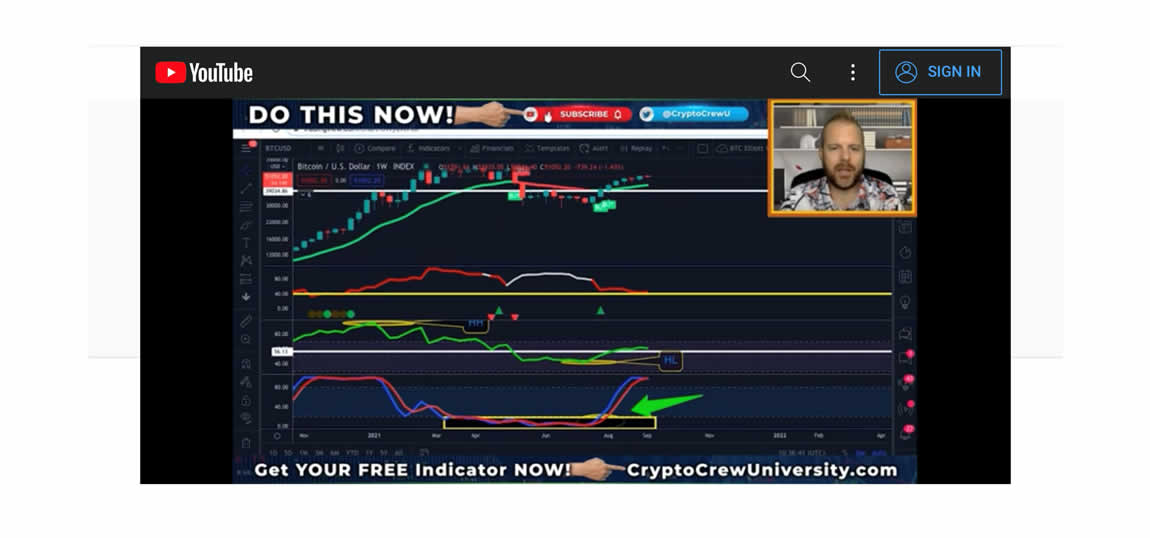

There are a lot of technical analysis experts out there. Steve Courtney of Crypto Crew University is one of the best! He is strictly technical analysis. We look hard at global macro as well. But from his analysis below, we can piece this together. First, here is a chart on the three box theory. Every bull cycle enters a box and consolidates. It enters the box 1.5 times the previous ATH and leaves the box at 4 times the previous ATH. See below:

We have not left the box yet! That would be around $80K. We have a ways to go first. We entered the box in mid May. A few months ago, in a blog, we thought we would leave the box in September or October. It will be very fun to see if this happens or if we stay in the box longer. Personally, I think it’s October. This next chart is really interesting. It looks at the NVT (Network Value to Transaction Ratio). NVT is the red and white line second from the top. When NVT drops below 20, turns white, then comes back above 20 in red on this chart. That is extremely bullish. NVT is at 20 and red right now. Steve developed this chart, custom. If NVT breaks above 20 in white, that is bearish. This could take into October to play out. Here is where the chart is now:

We will just have to keep watching this chart. Notice price action went up when NVT turned red in late July. In every bull run, which we are still in, when the NVT drops below 20, it comes out of that in red. That would prove how undervalued Bitcoin is, and would lead to parabolic price action. It also coinsides perfectly, to the Wyckoff Distribution pattern. In conclusion, Bitcoin is consolidating in the Wyckoff Distribution pattern and we are waiting on signs it truly is undervalued. Think of NVT as the P/E ratio of crypto currency. At some point NVT will break above 20, most likely in red. As Steve Courtney says, follow the chart, look left, no emotion. If NVT is white when it breaks, down she goes. The cycle pattern says, Bitcoin has room to grow before this bull cycle ends in late 2021 or early 2022!

“Bitcoin is getting investors scarcity, decentralization, and security during a decade of rampant money supply inflation, totalitarian central control, and security hacks!”

Neutral ATM buys and sells Bitcoin as little as $20 at a time! You do NOT have to buy an entire Bitcoin. Neutral ATM is here to get everyone off of zero Bitcoin.

Give Neutral ATM a try. We have low rates, convenient locations and we are expanding. Contact Neutral ATM, we will answer all your questions about Bitcoin and using our ATM machines. Find a Neutral ATM Bitcoin machine location near you.