Bitcoin; China re-opening is sparking inflation. El Salvador just proved to the world, Bitcoin as legal tender is safe

As per these two quoted sources, and there are many others. The fact that China is re-opening after 20 months + of covid restrictions is strengthening Oil demand. As we always say, Oil drives inflation. The next CPI print in February could surprise many. The DXY is tanking lately on this news, good for Bitcoin. Here are the quotes we have about this below:

Market Sentinal:

“China Economy is driven by USA economy, not the other way around. Stop being delusional about China re-opening. If much, it will fuel inflation a little more which is NOT bullish.”

Zero Hedge:

“*PETROLEUM DEMAND "RECOVERING" ON CHINA RE-OPENING: CHEVRON CEO”

Bitcoin is the inverse of the DXY (US Dollar index) chart. We expect more rate hikes in February as the DXY continues to tumble. Perhaps Bitcoin would pull back after the rate hikes are announced. Until then, the bulls are out to play!

States know the Fed is in trouble, and the treasury will have to bail them out at some point. Inflation is still a major risk. Therefore, Arizona is putting a bill forth for the second time to make Bitcoin legal tender. Oddly, this comes right after El Salvador made their $800 million bond payment without interference from the IMF. After making Bitcoin legal tender in 2021, click here to view article.

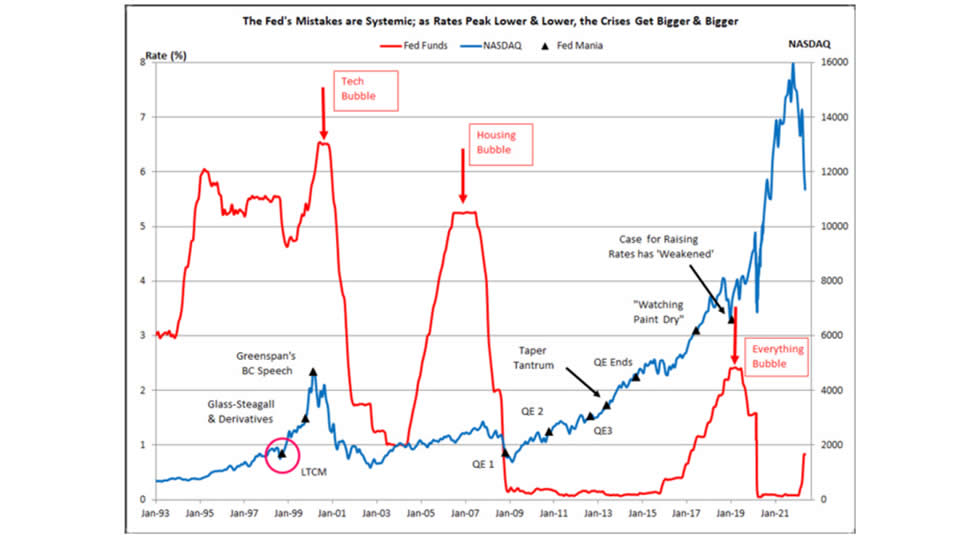

Many states should notice as rates peak at lower and lower levels, the sovereign debt crisis keeps getting bigger:

Also, this next chart shows global gold reserve holdings increase as global treasury reserve holdings decrease. Central banks are buying up gold, and not buying back their treasury bills. This weakens the buying power of the currency, while simultaneously the central bank is storing up a relic inflation hedge, gold:

We have proven in many past blogs how Bitcoin has out performed gold greater than 10:1 since 2009. As more and more US states join Arizona, and begin to create bills to make Bitcoin legal tender (Wyoming, Texas, Florida). Look at how legislatures become more open to passing these bills in the future! El Salvador is paving the way. They started down the Bitcoin as legal tender road, mainstream media said they would default, and now, they just paid the bond plus interest. El Salvador is flourishing and has survived the 2022 bear market.

Here is Nayib Bukele (El Salvador President) on Tucker Carleson last year, click here to view on twitter.

He makes a lot of sense. Here are two of his tweets after making the bond payment plus interest. Thus, proving to the world Bitcoin as legal tender works! Click here to view first article on twitter, click here to view the second article.

President Bukele also points out how the media portrayed El Salvador as a rogue state on the verge of default. Now, they are the only country in Latin America that does not borrow money from the IMF. They are self sufficient. That is the whole point of Bitcoin.

Meanwhile, Russian Foreign Minister Lavrov says BRICS will meet in August 2023 to begin rolling out the BRICS reserve currency to overtake the US Dollar, click here to view on Twitter.

Remember, Egypt, Iran, and Saudi Arabia are among 20 additional countries trying to join BRICS. Collectively, they represent close to 60% of the worlds population.

If that is’nt eye opening enough, Barry Sternlicht of Starwood Capital is saying on CNBC, that if the Fed keeps raising rates, it will make the debt service expense impossible to pay! The Fed will have to print the money to pay the interest on their debt, thereby ever increasing the national debt as rates soar out of control, unable to catch up to CPI. In other words, Weimar Republic, click here to view on Twitter.

This is why a gold and precious metal backed currency is critical (ie. BRICS reserve currency). This is why a digital, peer to peer money, on a public ledger is perfect for international settlements, or cross border payments. Since Bitcoin is more fungible than Gold, and much easier to get, even though it is more scarce than Gold. It’s a better investment. It solves a lot of problems. We are not financial advisors, and this is not financial advise. Keep Bitcoin offline, as it increases in value, more, and more online crime against Bitcoin holdings will happen. Use the following companies to store Bitcoin offline:

- Trezor.io

- Coldcard.com

- Unchained.com

Many will get caught unprepared for this monetary system shift. It is a seismic shift, schools don’t teach this. We do! We don’t want to leave anyone behind!

Neutral ATM is here to get everyone off of zero Bitcoin.

Give Neutral ATM a try. We have low rates, convenient locations and we are expanding. Contact Neutral ATM, we will answer all your questions about Bitcoin and using our ATM machines. Find a Neutral ATM Bitcoin machine location near you.